Ripple (XRP) holds a unique place in the crypto world because of its strong focus on cross-border payments and partnerships with financial institutions. Its price can move quickly, creating opportunities and challenges for investors.

Keeping track of ripple price requires more than a casual glance at market charts. Smart investors use a mix of tools and strategies to stay ahead. These methods help them react quickly to changes and spot price trends before they become headlines. Here are a few practical tricks investors can use to stay updated on Ripple’s market moves.

1. Use Reliable Crypto Tracking Platforms

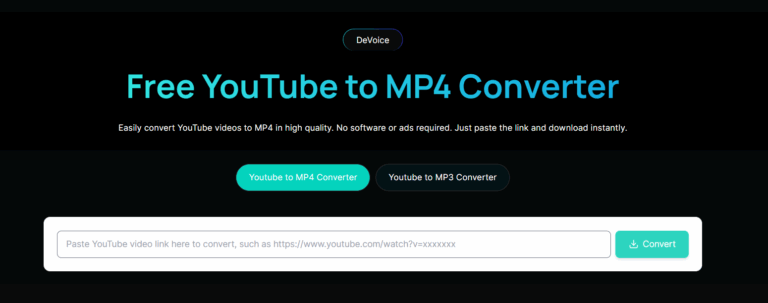

Investors need reliable platforms that provide accurate price updates for Ripple. Tools offer real-time prices in different currencies. They show trading volumes, market capitalisation, and daily price changes, which help investors spot patterns. Many of these platforms also allow custom alerts when XRP reaches specific price levels. These notifications help investors avoid missing key market shifts. A trustworthy tracking site can make a big difference when quick decisions matter.

2. Study Price Charts and Historical Trends

Price charts tell a story that goes beyond current numbers. Investors can study historical data to see how Ripple reacts to market cycles, news events, and investor sentiment. Candlestick charts, moving averages, and trading volumes provide clues about future moves. For example, a consistent rise in volume alongside price growth can indicate stronger demand. Simple chart analysis also helps investors avoid impulsive trades based on short-term spikes. Over time, this habit leads to more confident investment choices.

3. Follow Market News and Institutional Activity

Ripple’s price often reacts to global financial news, especially when it involves partnerships or regulatory decisions. Following credible news outlets that cover crypto updates helps investors stay informed. Institutions like banks or payment firms working with Ripple can influence its long-term value. When such partnerships are announced, XRP prices can move quickly. Tracking social media accounts of Ripple executives can also reveal hints about upcoming developments. Staying aware of global financial headlines keeps investors ready for market shifts.

4. Set Alerts and Use Mobile Tracking Apps

Convenience matters when monitoring a fast-moving asset like Ripple. Mobile apps make it easy to set instant alerts for price changes, percentage movements, or volume spikes. Apps such as Blockfolio or Delta provide detailed insights without requiring constant manual checks. They also sync with Exchange accounts to track portfolio performance in real time. This setup helps investors react faster to sudden changes in Ripple’s price. Consistent alerts prevent missed chances and add structure to a daily investment routine.

5. Monitor Trading Volumes and Whale Movements

Large XRP transactions, often called “whale movements,” can signal major price shifts. When a huge amount of XRP moves between wallets or exchanges, it usually hints at an upcoming trend. Websites like Whale Alert display these transactions in real time. Watching trading volume changes alongside such movements provides more context. Higher volume during a price surge can suggest genuine buying pressure, while low volume might signal short-term hype. Tracking these indicators helps investors make more precise calls on when to enter or exit the market.

Tracking ripple price takes a combination of good tools, awareness, and discipline. Investors who use reliable data sources, pay attention to trends, and stay alert to market news build stronger strategies. Instead of reacting to every headline, they use consistent observation to guide decisions. Through these practical tricks, investors can manage their Ripple investments with more confidence and clarity.